More About Paul B Insurance

Wiki Article

Indicators on Paul B Insurance You Should Know

Table of ContentsThe Single Strategy To Use For Paul B InsuranceGet This Report about Paul B InsuranceOur Paul B Insurance DiariesThe Best Strategy To Use For Paul B InsuranceNot known Details About Paul B Insurance Paul B Insurance - An Overview

Coinsurance: This is the percent (such as 20%) of a clinical fee that you pay; the remainder is covered by your wellness insurance coverage plan. Insurance deductible: This is the amount you spend for covered medical treatment prior to your insurance coverage starts paying. Out-of-pocket optimum: This is one of the most you'll pay in one year, out of your own pocket, for protected wellness care.

Out-of-pocket costs: These are all prices over a plan's costs that you have to pay, including copays, coinsurance and deductibles. Premium: This is the monthly quantity you spend for your medical insurance strategy. As a whole, the greater your costs, the reduced your out-of-pocket prices such as copays and coinsurance (as well as vice versa).

By this action, you'll likely have your alternatives limited to simply a couple of strategies. Below are some points to take into consideration following: Examine the range of services, Return to that recap of advantages to see if any of the strategies cover a broader scope of solutions. Some may have better insurance coverage for points like physical treatment, fertility therapies or mental healthcare, while others might have far better emergency situation insurance coverage.

About Paul B Insurance

Sometimes, calling the plans' customer support line might be the most effective means to obtain your inquiries answered. Write your questions down in advance of time, as well as have a pen or electronic device handy to tape the solutions. Below are some instances of what you could ask: I take a certain drug.See to it any plan you choose will pay for your routine as well as essential care, like prescriptions and experts.

As you're looking for the best medical insurance, an excellent action is to determine which prepare kind you require. Each plan kind equilibriums your costs and dangers in different ways. Consider your healthcare usage as well as budget plan to locate the one that fits.

Health insurance (additionally called wellness insurance coverage or a health insurance plan) aids you spend for clinical treatment. All medical insurance plans are various. Each plan sets you back a different amount of cash and also covers various solutions for you and also participants of your family members. When picking your insurance policy strategy, spend some time to think of your household's medical needs for the following year.

More About Paul B Insurance

You can find strategy summaries as well as obtain info about wellness plans for you and your youngsters in your state's Wellness Insurance Industry. Each strategy in the Industry has a recap that includes what's covered for you and your family members.When comparing medical insurance plans, look at these costs to aid you determine if the plan is appropriate for you: This is the quantity of money you pay monthly for insurance policy. This is the amount of cash you need to invest prior to the plan starts spending for your healthcare.

Your insurance deductible does not include your premium. (likewise called co-pay). This is the quantity of cash you pay for each health and wellness care service, like a visit to a health care supplier. This is the highest quantity of money you would have to pay each year for health care solutions. You don't need to pay even more than this amount, even if the services you require cost a lot more.

Below's what to try to find in a health and wellness plan when you're assuming regarding service providers: These suppliers have a contract (arrangement) with a health insurance plan to supply medical services to you at a discount rate. In a lot of cases, going to a preferred service provider is the least costly way to obtain healthcare.

Some Of Paul B Insurance

review This suggests a health insurance has different prices for different carriers. You might have to pay more to see some companies than others. If you or a family members participant currently has a health care supplier and you intend to maintain seeing them, you can locate out which plans consist of that provider.

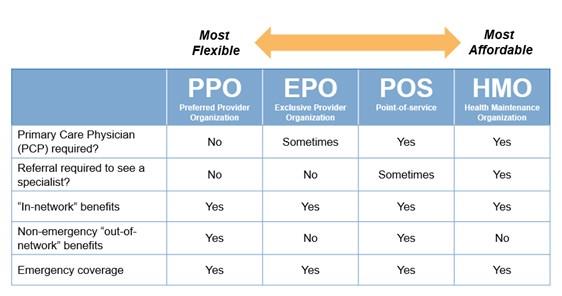

When comparing medical insurance strategies, recognizing the differences between wellness insurance types can assist you pick a plan that's finest for you. Wellness insurance coverage is not one-size-fits-all, and also the number of choices reflects that. There are numerous kinds of medical insurance prepares to pick from, and also each has linked costs and restrictions on service providers and also check outs.

To obtain ahead of the video game, examine your current healthcare plan to evaluate your protection as well as recognize your plan. As well as, have a look at for even more details healthcare plan info. To discover just how State Ranch may have the ability to assist with your medical insurance requires, call your representative today.

The Ultimate Guide To Paul B Insurance

If it's an indemnity strategy, what kind? Is that HMO standard, or open-access? With several strategy names so obscure, just how can we identify their kind? Given that the Bureau of Labor Data (BLS) started reporting on clinical strategies over 30 years earlier, it has identified them by kind. Obviously, strategies have transformed fairly a bit in 30 years.

A strategy that gets with clinical companies, such as healthcare facilities as well as physicians, to produce a network. Clients pay less if they utilize service providers who belong to the network, or they can utilize suppliers outside the network for a greater expense. A plan comprising teams of health centers and doctors that contract to provide comprehensive medical solutions.

Such strategies usually have differing coverage degrees, based upon where service occurs. As an example, the strategy pays a lot more for service carried out by a restricted set of providers, much less for services in a broad network of carriers, as well as also less for solutions outside the network. A plan that gives pre paid thorough healthcare.

Facts About Paul B Insurance Uncovered

In Exhibition 2, side-by-side contrasts of the 6 sorts of healthcare plans reveal the distinctions determined by responses to the 4 inquiries concerning the plans' features. Point-of-service is the only plan type that has more than 2 degrees of advantages, and fee-for-service is the only type that does not utilize a network.The NCS has not added plan kinds Homepage to make up these but has categorized them right into existing strategy kinds. As before, the plan name alone might not determine an unique and constant set of attributes. NCS does tabulate info on some of these special strategy attributes. For instance, in from this source 2013, 30 percent of clinical plan participants in exclusive sector remained in plans with high deductibles, and also of those employees, 42 percent had accessibility to a health and wellness cost savings account.

Report this wiki page